$TBPH Long

Theravance Biopharma ($TBPH) presents a distinct asymmetric opportunity, underpinned by $300 million in cash, ~$250 million in royalty value, and $250 million in milestones against a $950 million market cap. Management has indicated they will wind down operations if the pipeline fails, providing a tangible valuation floor.

The stock currently trades at a discount following a failed Phase 3 trial in neurogenic orthostatic hypotension. However, the company is advancing a new Phase 3 study based on a positive subgroup analysis from a randomized withdrawal period—a setup that typically warrants skepticism, yet in this case is supported by a strong biological rationale. The new trial specifically selects for responders, structurally biasing the study toward a positive outcome. If validated in the late February (ish) readout, the asset supports ~100% upside, assuming a 1.5x multiple on $700 million peak sales.

The Valuation Floor

At the end of 2025 Q3, Theravance reported a cash balance of $333 million. To bridge this figure to the expected CYPRESS trial readout in early 2026, we add two highly probable near-term milestone payments totaling $75 million. The first is a $50 million payment from Royalty Pharma, triggered by GSK’s Trelegy Ellipta exceeding $3.4 billion in 2025 global net sales—a threshold the drug was on pace to clear comfortably based on Q3 year-to-date performance. The second is a $25 million payment from Viatris, triggered by YUPELRI exceeding $250 million in 2025 US net sales. While the company achieved non-GAAP breakeven in Q3 2025, we will model a conservative $15 million net burn over the two-quarter bridge period. This results in a pro forma cash balance of approximately $393 million at the time of the catalyst.

Additionally, we have 35% profit-sharing interest in the YUPELRI franchise. Assuming peak sales of $400 million, the total franchise value stands at $800 million present value of 2x peak sales. Theravance’s 35% interest in this asset implies a value of $280 million to shareholders.

Beyond the 2025 payments accounted for above, Theravance retains rights to approximately $150 million in additional high-probability inflows. The most significant portion of this is a $100 million milestone from Royalty Pharma contingent on Trelegy Ellipta global net sales reaching approximately $3.5 billion in 2026. Given the drug’s current growth trajectory, this target requires only low-single-digit growth over 2025 levels. The remaining value is derived from the outstanding balance of eligible sales and regulatory milestones from Viatris for YUPELRI, which totaled over $200 million prior to the recent payouts. Attributing just $50 million of this remaining tail to the valuation provides a conservative estimate of future non-operating cash flows.

Aggregating these three components yields a total sum-of-the-parts valuation of $823 million, or $16.13 per share.

In case the readout fails, I would expect the stock to trade around $14 to $15. While this may not represent a discount high enough for the special situation funds, it would provide enough exit liquidity for everyone to exit who is playing just for the readout, I hope this article sheds some light on the fair value of these assets, and incentivize bulls to stick with their position if we were to see these price levels.

Also, feel free to share the article with your “pod” friends — referring to the funds who are short-term focused and their actions are not governed by what they believe to be the fair value of an asset, but rather what they believe others believe the fair value of the asset is —so may their beliefs be influenced about what the market beliefs the fair value of these assets are. Thank you for your cooperation in preventing an “overdump”.

MSA vs Parkinson & PAF

In Parkinson’s Disease and Pure Autonomic Failure, the pathology is primarily peripheral and post-ganglionic. These patients suffer from frank denervation—the physical death of the neurons connecting the spinal cord to blood vessels. While central centers remain intact, the peripheral “wire” is severed, causing profoundly low plasma norepinephrine levels. Consequently, patients often show a deceptive, transient response to medication due to “denervation supersensitivity,” where starved receptors become hyper-responsive. However, this is unsustainable; as receptors downregulate or remaining stores deplete, therapeutic efficacy is rapidly lost.

In contrast, Multiple System Atrophy pathology is central and pre-ganglionic. The post-ganglionic fibers directly innervating blood vessels remain largely intact. Instead, alpha-synuclein accumulation causes extensive demyelination of central pathways in the brainstem and spinal cord. The peripheral hardware remains functional, but the signal from the brain is dampened. This preservation is confirmed by the fact that MSA patients typically exhibit normal or elevated resting plasma norepinephrine, indicating that the capacity for release is preserved even if regulatory control is lost.

This distinction is critical when considering the baroreflex, the body’s primary feedback loop for pressure stabilization. In a healthy individual, baroreceptors in the carotid sinus and aortic arch detect a drop in pressure upon standing and relay this information to the brainstem. As illustrated in the diagram, this signal prompts the rostral ventrolateral medulla (RVLM) to drive sympathetic outflow down the spinal cord to the intermediolateral nucleus (IML). These preganglionic neurons project to sympathetic ganglia (such as the stellate ganglia), where acetylcholine (Ach) mediates the signal transmission to postganglionic fibers. The sympathetic surge triggers the release of norepinephrine from these post-ganglionic nerve terminals, which binds to alpha-1 and alpha-2 adrenergic receptors on vascular smooth muscle to induce vasoconstriction and beta-1 adrenergic receptors on the heart to increase heart rate and contractility. In MSA, the central demyelination prevents this sympathetic command from being transmitted effectively to the periphery. The signal is generated but dissipates before it can trigger a robust release of norepinephrine, resulting in a failure to constrict vessels against gravity

This physiological framework identifies MSA as the ideal target for ampreloxetine, a norepinephrine reuptake transporter (NET) inhibitor. Unlike PD or PAF patients who lack the physiological substrate to inhibit, MSA patients possess both the neurotransmitter and the intact nerve terminals required for the drug to function. Ampreloxetine operates by blocking the NET transporter, which is responsible for recycling norepinephrine back into the nerve terminal after release. By inhibiting this reuptake mechanism, the drug allows norepinephrine to persist longer in the synaptic cleft, thereby increasing its concentration and the duration of its interaction with alpha-1 and beta-1 receptors. This mechanism effectively acts as a peripheral amplifier; it potentiates the blunted central signal, artificially restoring the volume of the sympathetic response so that even a weak central command can result in sufficient vasoconstriction to maintain blood pressure.

Supine hypertension & nOH

To fully grasp the therapeutic window for ampreloxetine, one must understand the counterintuitive relationship between neurogenic orthostatic hypotension (nOH) and supine hypertension. While these conditions appear to be opposites, they are physiologically inseparable in autonomic failure. Empirical data establishes a direct link between the two phenotypes: “Patients with MSA or PD lacking OH did not have supine hypertension. Individual values for supine mean arterial pressure correlated negatively with orthostatic changes in mean arterial pressure (r=-0.40, p<0.0001).”

The mechanism driving this duality rests on the specific deterioration of the baroreflex arc . In a healthy functioning system, the baroreflex acts as a bidirectional regulator: it stimulates sympathetic outflow when pressure drops (standing) and inhibits it when pressure rises (lying down). In Multiple System Atrophy (MSA), the central lesion uncouples this regulatory loop. The resulting pathology is best described as a state of “disinhibited residual tone.” As the disease progresses, the central dampening mechanisms fail, leaving the intact post-ganglionic neurons without their regulatory “brake.” Consequently, these neurons continue to fire at a baseline rate even when the patient is supine. Because the central command cannot downregulate this firing in response to the increased venous return of recumbency, the result is supine hypertension. The severity of orthostatic hypotension tracks so closely with supine hypertension because they are two sides of the same coin: the same central disconnection that prevents the massive sympathetic surge required to maintain standing blood pressure also prevents the withdrawal of sympathetic tone required to normalize supine blood pressure.

The investment implication of this physiology is that the ideal candidate for ampreloxetine is a patient who retains residual autonomic function. The goal of norepinephrine reuptake inhibition is to amplify the baroreflex, not to indiscriminately boost baseline pressure. If a patient has completely lost all reflexivity and relies solely on unregulated “random” firing, amplifying that signal may exacerbate the supine hypertension without meaningfully improving the orthostatic drop. Therefore, the drug is mechanically positioned to benefit patients who are “less advanced” in their autonomic progression.

Proof from adjacent MOA

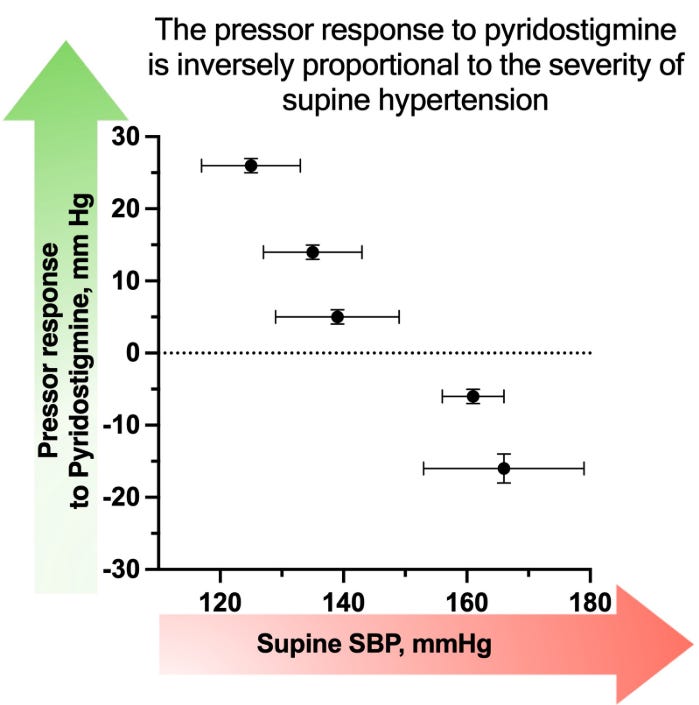

This advancedness theory is independently corroborated by data from trials involving pyridostigmine, a cholinesterase inhibitor that functions as a broad-spectrum signal amplifier. The mechanism of pyridostigmine is upstream of NET inhibitors: rather than targeting the end of the nerve like ampreloxetine, it acts at the relay station (the autonomic ganglia) by inhibiting the breakdown of acetylcholine. Since acetylcholine is the neurotransmitter responsible for transmitting the “fire” command from the spinal cord to the peripheral nerves, pyridostigmine effectively turns up the volume on the brain’s central output. However, clinical data reveals a critical limitation: the drug increased upright blood pressure by an average of 4 mmHg, but with massive heterogeneity ranging from -20 to +29 mmHg. This variance was not random; it was strictly dictated by the health of the remaining nerves. The pressor response was stongly negatively correlated with indices of autonomic severity, such as supine blood pressure and the pressure recovery time of the Valsalva maneuver.

This confirms that for an amplifier to work, there must be a signal to amplify. Patients with preserved autonomic markers responded well, while those with progressed disease derived little benefit. Crucially, pyridostigmine is a dirty amplifier because acetylcholine acts as the primary fuel for the parasympathetic system at both the ganglionic relay and the target organs. By flooding the system with acetylcholine, pyridostigmine indiscriminately activates the vagus nerve (slowing the heart). In advanced patients where the sympathetic pathway is broken and cannot convert this cholinergic signal into a norepinephrine release at the blood vessel, the drug essentially fuels only the parasympathetic side.

Ampreloxetine avoids this liability. While it increases norepinephrine levels centrally (which in a healthy brain might trigger a reflexive parasympathetic brake) this signal is outpowered by the sympathetic signal, and as the connection is severed and the baroreflex signal dies down, so does the parasympathetic signal in tandem, so it does not harm more advanced patients (or at least not in this way). Consequently, ampreloxetine acts as a cleaner sympathetic booster: it potentiates the vascular squeeze with minimal antagonization by a functional parasympathetic response, making it the superior physiological tool for these specific patients.

Ampreloxetine responders

The pivotal clinical program comprised two distinct study designs: SEQUOIA, a standard 4-week randomized controlled trial (RCT), and REDWOOD, a randomized withdrawal study.

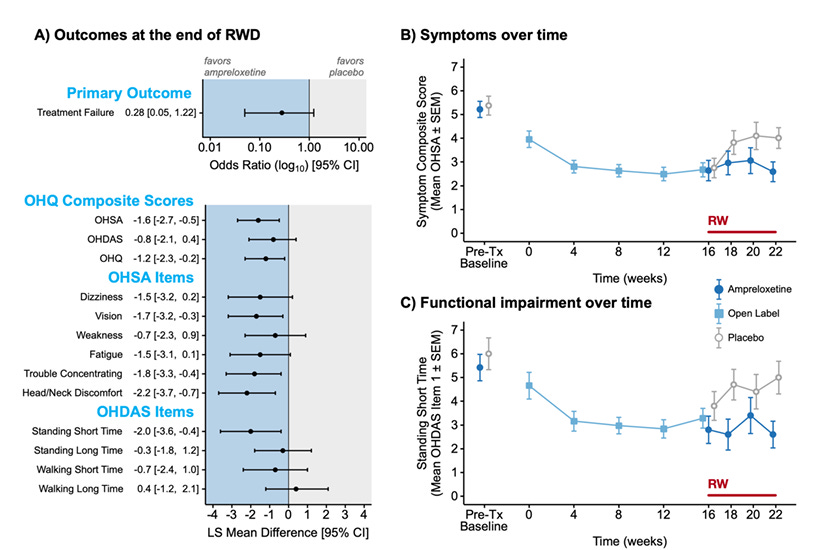

SEQUOIA enrolled a mixed population of nOH patients and failed its primary endpoint. Following this negative readout, the sponsor terminated the REDWOOD study early. This decision drastically curtailed enrollment, leaving REDWOOD with only 21 MSA patients randomized to ampreloxetine and 20 to placebo for the withdrawal phase.

This abrupt shutdown severely compromised the statistical power of the REDWOOD study. The primary endpoint—Treatment Failure (a composite of worsening symptoms or blood pressure)—yielded an Odds Ratio of 0.28 favoring ampreloxetine. While the point estimate suggests a strong treatment effect (a 72% reduction in the odds of failure), the insufficient sample size resulted in a wide 95% confidence interval of [0.05, 1.22]. Because this interval crosses unity, the result technically failed to reach statistical significance, a direct artifact of the underpowered cohort rather than a lack of efficacy.

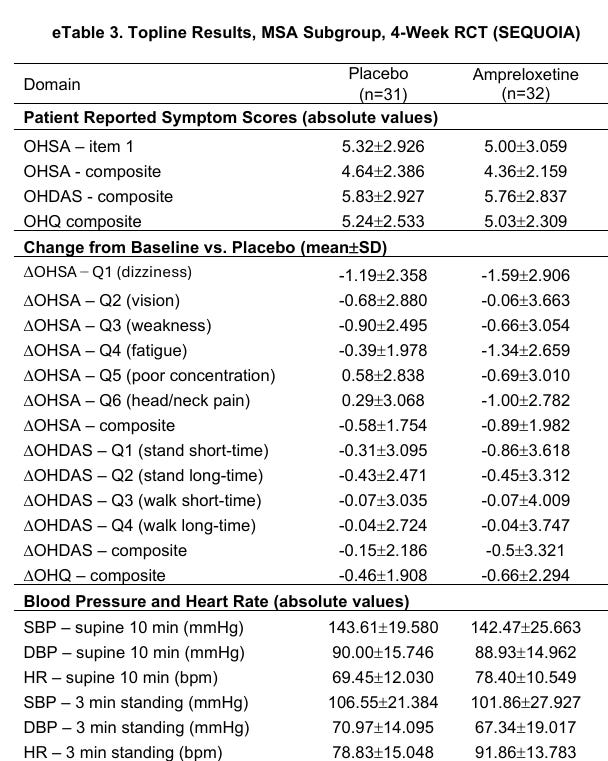

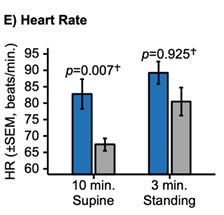

Despite the power neediness binary primary endpoint, the physiological data reveals a clear efficacy signal driven by patient selection. The REDWOOD enrichment design successfully filtered for patients with preserved autonomic function, creating a distinct physiological profile compared to the “all-comers” in SEQUOIA.

Comparing the placebo arms of both trials highlights this difference:

SEQUOIA Placebo (All): Patients exhibited a supine heart rate of 69.45 bpm and a standing heart rate of 78.83 bpm, a blunted increase of roughly 9 bpm.

REDWOOD Placebo (Enriched): Patients exhibited a lower supine heart rate of approximately 67 bpm but mounted a robust compensatory response to over 82 bpm upon standing, representing a delta of roughly 15 bpm.

Both a higher supine heart rate and blunted orthostatic heart rate rise signals a failed sympathetic baroreflex (see correlation between supine hypertension and orthostatic hypotension above). This indicated that the REDWOOD trial enrolled people with more preserved baroreflex.

The fact that the drug performed significantly better in this setting is unlikely to be a statistical fluke, as this is exactly what you would expect based on the mechanistical explanation outlayed above.

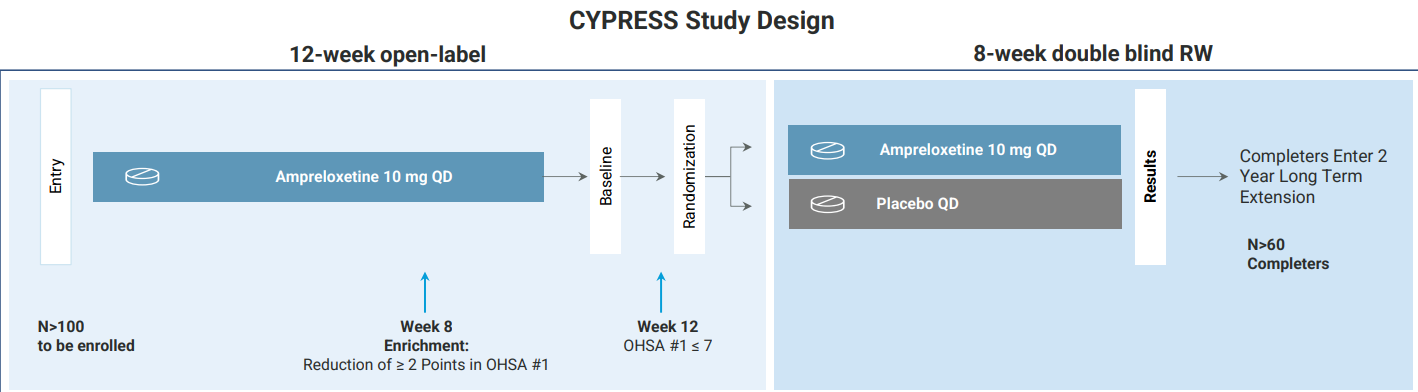

CYPRESS — Power optimised REDWOOD

Theravance has initiated the Phase 3 CYPRESS trial, which largely retains the core design of the REDWOOD study. The protocol includes a specific adjustment to the enrichment timing: the requirement for a reduction in OHSA #1 score of at least 2 points to qualify for randomization has been moved from Week 4 in REDWOOD to Week 8 in CYPRESS. This adjustment allows a longer duration for the therapeutic effect to stabilize, which will likely result in a larger fraction of the population enrolling into the RW. Additionally, the duration of the double-blind randomized withdrawal phase has been extended from six weeks to eight weeks. This extension provides additional time for the placebo group to deteriorate following drug cessation, potentially widening the separation between the treatment arms. The study aimed to enroll 102 patients to achieve a target of 60 randomized completers, aiming for a conversion rate of approximately 60%. This sample size is designed to provide definitive statistical power, addressing the limitations of the curtailed 41-patient cohort in the previous study.

Conclusion

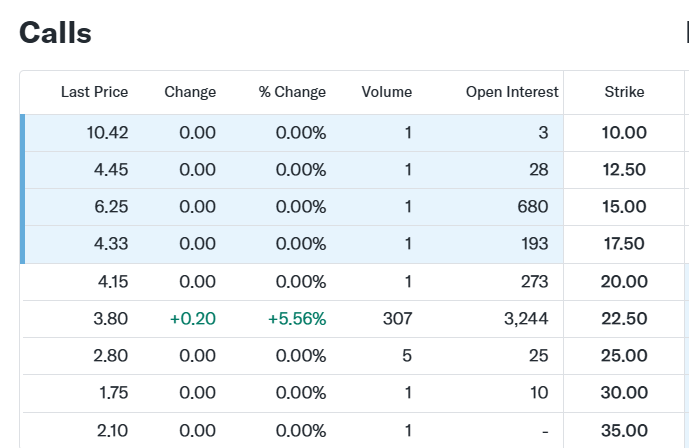

For execution, the March 2026 options offer the most compelling vehicle. The current pricing structure implies a low probability of clinical success, creating an ttarctive entry for bulls. Interestingly enough, the ratio between the $22.50 calls ($3.80) and the $30.00 calls ($1.75) suggests that if the data is positive, the stock should clear $30.00 easily.

Disclosure

The views and opinions expressed in this article are strictly those of the author and do not reflect the official policy or position of any past employers or affiliated organizations. This content is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any security.

About the Author I am a sophomore at Dartmouth College actively seeking a US-based buy-side internship in the biotech space. I am specifically looking for opportunities that offer strong mentorship to further develop my investment framework. If you are interested in connecting for work opportunities/learning more about TBPH, please reach out at aron.markovics.28@dartmouth.edu

CYPRESS Trial Design (NCT05696717)

Summary: The official registry for the ongoing Phase 3 CYPRESS trial, confirming the “enriched” design that recruits only responders who show a >2 point reduction in dizziness during the open-label run-in (the “watering up” strategy).

REDWOOD Trial Design & Results (NCT03829657) & Protocol PDF

Summary: The failed Phase 3 trial that provided the post-hoc signal; specifically relevant for contrasting the “all-comers” population (which failed) with the MSA subgroup signal that inspired the new trial.

Theravance Biopharma Investor Materials

Summary: Source for the company’s financial data (cash runway, capitalization), the “success-based” milestone payments from GSK/Viatris, and the specific subgroup data (Heart Rate deltas) used in your valuation and trial analysis.

Goldstein et al., 2017 (PMC5248558)

Summary: Establishing the “Storage Defect” distinction; proves that PD patients have a vesicular storage defect (cannot store NE), whereas MSA patients have intact storage capabilities, supporting the thesis that MSA nerves are functional but unregulated.

Biaggioni et al., 2015 (PMC4431657)

Summary: A foundational paper on “using clinical pharmacology to reveal pathophysiology,” arguing that NET inhibitors (like ampreloxetine) require intact residual sympathetic tone to function, making them effective in MSA but ineffective in pure autonomic failure.

Smith et al., 1990 (PubMed 2356008)

Summary: Direct microneurography evidence showing that MSA patients have “spontaneous bursts” of sympathetic activity (wires are firing), whereas PAF patients have “neural silence” (wires are dead), validating the drug’s mechanism of action.

Shindo et al., 2017 (PubMed 27826809)

Summary: Demonstrates that MSA patients can still mount a muscle sympathetic nerve activity (MSNA) response to tilt (unlike PAF), confirming the presence of a “blunted” but amplifiable signal.

Recent Pyridostigmine Study (PubMed 39727053)

Summary: The “independent corroboration” of your advancedness theory; shows that signal amplifiers (like pyridostigmine) only work in patients with residual autonomic function (preserved HR/BP ratios) and fail in those with severe progression.

Supine Hypertension & OH Correlation (PMC10741317)

Summary: Establishes the link between severity of Orthostatic Hypotension and Supine Hypertension, supporting the argument that high resting pressure is a biomarker for “unregulated” but active nerves in MSA.

Summary: Statistical evidence that patients with autonomic failure who lack orthostatic hypotension also lack supine hypertension, reinforcing that the two symptoms are mechanistically linked to the same “broken reflex.”

MSA Pathology Review (PMC2676993)

Summary: Details the Lewy body pathology in adrenal glands, helping distinguish the specific “peripheral” vs. “central” damage sites in different synucleinopathies.

Sympathetic Mechanisms (Springer 10.1007)

Summary: General physiology of blood pressure regulation, useful for explaining the “Baroreflex Arc” to the lay reader.

MSA General Review (PubMed 36008429)

Summary: A broad overview of Multiple System Atrophy to establish the clinical baseline for the article.

Summary: Discusses comorbidities in autonomic failure, useful for context on why these patients are fragile and difficult to treat.